Articles

You may also get as many as 20 records and you can fund tend to be deducted directly from the XBet membership. For each an identical post, when the multiple participants continue to be alive just after Few days 18, they will split up the newest 5,one hundred thousand evenly. For each and every the website, the brand new XBet 5K Survivor Tournament begins Week 1 ( casino supercat reviews play online Thursday, Sep 4, 2025) of the 2025 NFL typical year. As the specialist activities seasons roars for the equipment, XBet will be here featuring its fantastic annual 5K Survivor Competition who has the fresh condition to have 2025 who’s started mutual on the the site. Out of choosing the downright champ in order to fun prop bets, such as who’ll make it to the last tribal council, there are many a method to bet on it humorous let you know.

Complete Retirement To have SURVIVOR Pros

- Clark and the Hawkeyes is into the new Federal Championship Game to your second successive seasons.

- For instance the brand new manager, you generally won’t owe tax for the property regarding the IRA until you discover distributions from it.

- If you will rating annuity costs to own a predetermined level of ages, instead mention of the your life expectancy, you should figure the asked return according to you to repaired count away from many years.

- They offer party and you will user statistics, and this painting a much sharper photo than issues scored otherwise win-losses facts.

- 2025 work with number reflect dos.5percent cost-of-way of life modifications (COLA) for a max number of earnings from 176,100 subject to the fresh Public Protection income tax.

- But not, as required because of the the new Ca User Privacy Work (CCPA), you can even list your decision to access otherwise remove your own personal advice because of the completing the design less than.

Within the Season 49, she provided partner favourite contestant Carolyn 100k, as well as Carson and you can Lauren 15k per. It opened another door so you can possibly make some cash to your participants. Once storming the newest phase so you can prize Tai currency for saving his poultry buddy inside Kaoh Rong, Sia generated a practice away from out awarding 10s in order to countless several thousand dollars to help you castaways who she such enjoys. Therefore even though it’s risk when deciding to take such time away of strive to motion picture the new reveal, participants to the Survivor can really build a fairly penny of looking.

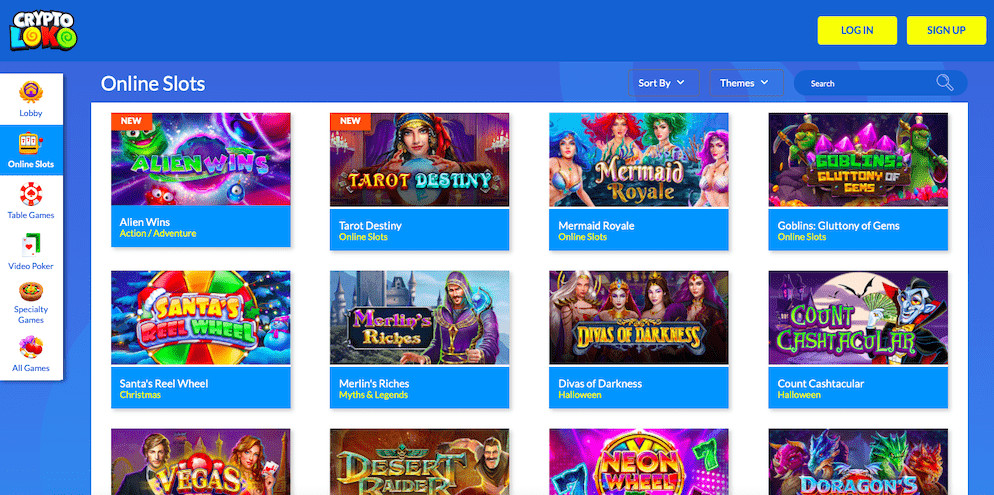

Cellular Amicable 5 Deposit Casinos

In the event the a few participants stay in Week 14 and you will one another discover shedding organizations, those participants often broke up the newest honor pond. In case your tournament closes no survivors, the fresh participants which have live records heading to your latest day of the newest competition often split the new 5,100 prize. For example, if five participants stay-in Month 14 and you may about three contestants see shedding groups, the rest contestant are stated the new champ. Simultaneously, the fresh event comes to an end to the Day 18 of the 2025 NFL season, or when only 1 contestant is left; any will come very first. The newest contestant(s) one picks successful teams the new longest, rather than searching for a burning team, is the 5K Survivor Tournament champion.

Free Survivor Games

Early distributions from money from a simple retirement account produced in this 2 yrs from delivery involvement from the Easy is actually susceptible to a great twenty-fivepercent, as opposed to a tenpercent, very early withdrawals taxation. The excess income tax to the very early distributions try tenpercent of your own number of the first delivery that you must are on the gross income. If the both you and your mate are very first-date homebuyers (outlined afterwards), each one of you is discovered distributions to 10,one hundred thousand to have a first home without having to pay the fresh 10percent a lot more tax.

To your November 8, 2025, at the ages sixty, Amelia took a 7,100000 delivery from their Roth IRA. Forget any recharacterized sum one ends up in a keen IRA other than a great Roth IRA for the true purpose of group (aggregating) both efforts and you can distributions. If you found a distribution from the Roth IRA this is not a professional shipping, section of it may be taxable. You might not have to pay the newest tenpercent a lot more tax on the after the things. You must along with spend the money for tenpercent extra taxation for the one portion of the shipment due to income on the benefits. You must pay the 10percent additional income tax in the year of your own shipment, even though you got integrated the new sales otherwise rollover share inside the a young 12 months.

Having fun with video game concept in the survivor swimming pools

Playing with look-ahead contours and you will energy analysis isn’t best since the teams alter and you may develop regarding the season, however it’s an informed i’ve had to own thought away a survivor season. Allowing me personally choose the new groups with multiple feasible days which is often wise to help save to own later on from the season. Yet not, taking into consideration how many other folks have selected a certain team can provide a huge advantage over the rest of the brand new pond. If you were trying to take the most likely champion such as the basic strategy, and you may progress to the next few days, then Chiefs would be the noticeable choices.

Awesome Dish sixty MVP Possibility, Previous Winners, Forecasts

Such as, let’s guess Jim’s full retirement age work for try dos,one hundred thousand. It’s designed to offer particular defense to have enduring spouses in the event the lifeless companion recorded during the, or near, the earliest many years you are able to. Exactly what if the dead companion submitted to own advantages just before the guy died? You can observe the next chart more resources for years-founded decreases which come to your gamble in the two cases. The simple factor would be the fact at the death of the first companion, enduring partners gets the higher of one’s own work for, or even the advantage of the new inactive.